Forex trading is one of the largest market in the world with almost $5 trillion daily volume when you compare with the equities, it is just $85 billion and US Treasury market is $550 billion. So it is bigger than the US equitues and Treasury markets put together

Where do these Forex markets operate?

We have different stock exchanges for equities like New york stock exchange, London stock exchange, Bombay Stock exchange located at their respective cities.

But for Forex - there is no physical location!

You heard it right. There is no central location for Forex market, it is only the global electronic network of banks, financial brokers, financial institutions and traders who buy and sell currencies

When do these Forex markets operate?

One of the interesting future for Forex market is it operates 24 hours a day except on weekends

Let us consider Asia/Kolkata as the base time, becuase when i start trading from India I usually wait for US market to open

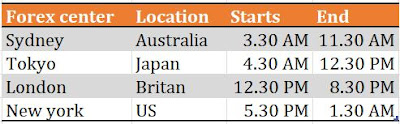

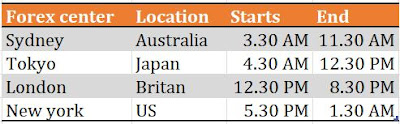

So it usually go in this - Firstly Australian market, next Tokyo, next London and finally US market. Lets check the timings

|

| Forex market timings |

Note: I have considered the Indian timing as base currency, if any one trading from any other country can check the timing zone here

Gradually what happens is - the daily rountine of Forex trader would change according to the respective timing zones of Forex center in which he trades. As i mosty trade in US stocks i used to wait for US market to open and my routine has been changed to working nights but thats exciting

Little Background

Earlier this forex market is available only for Banks and big financial institutions who used to trade and do large heding transactions but now its available for every individual trader. Whoever interested to trade in Forex, they can simply open an account and start being part of this largest market

Forex market is broader in terms as sometimes it usually benefits the retailers too who are holding currencies if there are fluctuations in exchange rates

Lets take an illustrative

Mr. Dam has $10000 in his account idle and he bought Euros when the rate was 1.10 and after couple of days when Euro currency has increased, he sold off all the Euros and got more Dollars in his account

This is a simple trasnaction he has made to take the advantage of the fluctuations in the exchange rates

How does the Quote look like

EUR/USD - 1.10000 which means One Euro is worth 1.10 dollars. The First currency is the base currency and the next one is Quote currency

This Forex market will flourish as the international trade is growing tremondously which will need exchange of different currencies

Why this Forex trading has become so popular and 10 reasons why you should start Forex trading

Here i am going to share some interesting facts about Forex trading

- Trade Anywhere - You can trade anywhere from your house, college, office, coffee shop etc. What you just need is Internet connection and the minimum amount to trade. I used to trade in mobile, so even when i am travelling also i can trade in different currencies

- No Qualification: It does not require any Master degree where people spend lot of money on getting a degree, there are lot of informative videos in Youtube where you can learn and trade in Forex. So you have saved few thousands of dollars!. It does not require experience as beginneres also can start forex trading and make money if followed discipline

- Cost/Investment: You can start trading with as low as $10 and depends on different brokers on what they offer. I personally use IQ option for Forex trading where the user interface is very nice and placing the order is easy

- Trade Anytime: As Forex markets open 24 hours a day considering multiple forex market centers, you can chose flexible time for trading. But is it true, does forex traders trade all the day - They will go mad if they trade all the time. Traders select their trading time and currencies based on their comfort levels

- Leverage: This is treated as both advantage and disadvantage. Its like a slow poison. Forex brokers offer leverage from 100:1 to almost 800:1 which means for evey one dollar you have they offer 100 times your money for trading. So even a slight fluctuation in currencies will have greater impact on their portfolio accounts. The Margin requirements for trading in equities range upto 50% of stocks but the same is different when you trade in Forex i.e 100:1 referes to 1% margin required for the total contract size. There are different types of accounts - Standard, Mini and Micro.

- Liquidity: As discussed in the begining of the daily trading volume of Forex market is $5 trillion which has capacity to absorb large trades that can offer high liquidity all the time

- No Hidden Fees: You dont have to pay any exchange fees and clearing fees. Becuase these dont trade on any exchanges they dont have any fees unlike equities that trade on stock exchanges which involve transaction costs

- Brokers Commission: By reading the above point you might have understood that if there are any fees, how the forex brokers are going to make money - it is simple when you trade any currency pair it has bid rate and ask rate. The spread between the bid and ask rate is the commission of the broker that he earns.

- Transperancy: It is required in any market for traders. We know many scams that are being happened in the market. Now a days we have access to information about all countries - what is happening in their countries and how it is going to impact the other countries w.r.t international trades. So it is easier when compared to analysing individual companies

- Faster Execution: Since this is highly liquid market, any order you place will be executed within seconds. Now everything is online which makes easy to execute

So after considering the above important facts, its exciting to start forex trading

How much capital required for Forex trading?

Now we will be looking at how much money we should have to start Forex trading or how much capital is ideal to trade forex. So before that lets understand something about Margin requirements

The Next Question arises, how much Investment is required for Forex trading. It depends on the Concept called Margin

Margin: Margin is the amount that is required for a particular trade or for Currency pair. It varies mainly on Account Type

Account Type: It is the type of account that you open and trade. There are three types of Accounts

- Standard Lot (100,000) Units

- Mini Lot (10,000) Units

- Micro Lot (1000) Units

So if you start with Standard Lot i.e. 10,000 units will be considered for every trade

Now Lets Considered the Margin required for Mini Lot for a Currency Pair EUR/USD .

There is a Simple formula for calculating the margin required = (Trade Volume/Leverage)*Currency Exchange Rate

Leverage: Leverage is the additional amount that brokers provide you for trading on your investment. Different brokers provide different leverage options. Example - XM Forex Broker offers leverage upto 800 times your investment So it means if you invest $100, you are allowed to trade almost $80,000 worth of trade

In this example we will assume that they provide you 100 times of leverage

So from the formula mentioned above Margin required for One standard lot for EUR/USD = 1*(100,000/100)*1.08405 which comes to $1084.05

Check in the image below

You can try for any other currency pair along with base currency and provide required inputs - calculate the margin here

So you need approximately $1000 to trade assuming with 100:1 leverage

How do you calculate the profit in Forex trading?

Now when we start our investment with $1000, we have taken One standard lot of EUR/USD and the current exchange rate is 1.08405

Lets assume if the current exchange rate moves by 5 pips (pips means that change in basis points of 4th decimal) and EUR/USD went to 1.08455, your current value of investment would go to 1,00,000*1.08455 = 1,08,455

The difference amount comes at $50, so the profit is $50

Lets calculate the Return on investment in Forex trading -

ROI = $50/1084.05 which comes around 4.61%

So for every 5 pips change, you are going to make $50. If the currency rate change to 50 pips i.e. 1.08905 you will make $500 which is 50% ROI

Wow thats amazing right. This is what excited every trader to enter into this Forex

Note: All this i assumed the 100:1 leverage. If i assume at 400:1 leverage your investment required is only $1084.05/4 i.e. $271. But if we take more leverage, what happens is if the prediction goes against you - every single pip change will have huge impact on your investment

Lets say if the EUR/USD went down from 1.08405 to 1.08355 it means loss of 5 pips

ROI = -$50/271 which comes around 18.5% loss of your capital

Ofcourse if you dont have the required capital to trade Standard Lot, you dont have any choice except to take Leverage. Some brokers offer the super high leverage of upto 800:1 which is quite dangerous. The recommended or the ideal leverage one can take would be 100:1

Risk: Unlike Futures trading where the risk of loss would go beyond your investment, in forex trading all the amount you can lose is the investment/margin you have put into your acccount

Relatively Forex trading is less riskier than Futures trading where large impact will be having due to huge gapup or gap down for overnight positions. You cant even put stop loss for overnight positions

Which is the best currency pair to trade in Forex?

Lets see the most individual currencies that are selected for trading. These are USD, EUR, GBP, JPY, CHF, AUD, CAD

You can not trade individual currencies alone, there should be a currency pair like USD/EUR, USD/AUD etc

Some of the best currency pair that are most commonly traded

- EUR/USD - Euro against US Dollar

- USD/JPY - US Dollar against Japanese Yen

- GBP/USD - British pound against US dollar

- AUD/USD - Australian dollar against US Dollar

Lets assume you are buying the currency pair AUD/USD i.e. you are buying Australian dollar and selling US dollar. In the same way you can sell the Currency pair which means you will be selling Australian dollar and buying US dollar

Rules you must follow while trading Forex

There are two rules that you must follow while trading Forex

Rule 1: Cut your loses and ride your winners

Losses and profits are part of the game, you can not make every trade into winning trade. There might few trades where you see the loss the moment you enter the trade, that is the time where you have to cut your losses. One thing you should remember is Never fight with the market and dont try to prove you are right. Accept your mistake and loss, move on to your next one. If you want to make forex trading as living, you should be disciplined and consistent

Risk management is the big concept in trading. One has to follow the stop loss for every trade he does. Practically what happens is few traders try to put the stop loss immediately after they have taken the position but when the price to reaches your stop loss you try to modify your stop loss or remove the stop loss expecting market to recover. Remember if you can not abosrb or have the mindset of accepting losses you can not become successful trader. Always fix your stop loss according to your capital size, the amount that you can lose in any particular trade or based on your risk appettite. In general case what should be the stop loss in forex trading - it can be 1% of your capital which means that you can lose maximum of 1% in that particular trade

Keeping this stop loss would help you to experience the market and helps you to stay in the market. If your stop loss is wider you might not stay in the market for long if that trade goes against you

Okay, now we understood the forex trading, capital required, return on investment or profits calculations and basic fundamental rules to be followed

Now let us understand the important thing i.e.how do we predict Forex prices

How to read charts and Forex prices?

This is the most critical point in forex learning because this is the heart of Forex trading, without analysing and reading those charts, you can not blindly trade Forex

Technical analysis and own strategies are being used by forex traders in predicting the trend and take entry exit decisions. Dont worry about the difficulty of technical charts, everything comes with experience and always be a continous learner

The Platform which i use to read the charts and draw trendlines is TradingView

Let us discuss some basic chart types and we will discuss in detail of forex trading strategies in another article. This is just an overview

- Bar Charts - Its a linear representation of a particular time period. The top of the bar represents the highest traded price, the bottom of the bar represents the lowest bar, the left side dot represents the opening price and right dot represents the closing price

- Candlesticks - These are commonly known as Japanese candlesticks and the red colour candle represents the close was lower than the open price and Green colour represents the close was higher than the open price

Which time frame should be used for Forex trading?

Lets see what timeframes we have for trading - 1 min, 5 min, 15 min, 30 min, 1 hour, 2 hours, daily charts, weekly charts, monthly

What timeframe should be understood - In general it depends on the trader for how long he is going to stay for that particular trade

- Short term entry and exit - 5 minutes chart would be ideal for entry and exit. However one has to be overseeing the macro trend (like 15 min and 30 min) too which would help them to undertand where market is heading

- Long term - Daily charts and weekly charts are used for Trend identification

Note: 1 Min charts are very difficult to use and are not good for intraday trading as the forex markets are too volatile

What information to track and does fundamental factors like Economic events impact Global Currencies?

As discussed earlier, there are many better features in forex trading than in stock trading. In terms of Learning and access to information is higher in Forex trading than equity stocks. You have to watch global news, economic changes in different countries and its impact on Global currencies and up to date with all the industry changes. Regulary watch sites like Fx street, Daily Forex, Forex factory, Market pulse etc to get latest news and its analysis on the markets

So on a macro level fundamental facors effect the bigger price momentss but on a micro level technical analysis like reading charts and price patterns will prevail in identifying the trend. Always try to connect the dots and eventually you will build analytical skills and become a matured trader

Neverthless both fundamental and technical analysis should go hand in hand. One should be a continous learner and focus on improving your mistakes daily. Keep a Journal of trades what you are doing and reduce the mistakes over the period of time which will help you to become successful trader

Conclusion: This is the basic understanding of how forex trading works and some key information one should know to trade Forex. In my other articles we will discuss many topics like How to select a Right broker, Strategies to be followed, Principles to beccome a succcessful trader and many more

Do remember success is not a overnight Job, do believe in continous improvement and Never give up!

Comment below the trading capital you use for trading Forex along with Leverage you use. Have a great day

Very well written article. It was an awesome article to read. Complete rich content and fully informative. I totally Loved it. fxgrow no deposit bonus

ReplyDeleteThis is a brilliant blog! I'm very happy with the comments!.. Best etf for 2021

ReplyDeleteCool stuff you have got and you keep update all of us. Best etf for 2021

ReplyDeleteAll thanks to Mr Anderson for helping with my profits and making my fifth withdrawal possible. I'm here to share an amazing life changing opportunity with you. its called Bitcoin / Forex trading options. it is a highly lucrative business which can earn you as much as $2,570 in a week from an initial investment of just $200. I am living proof of this great business opportunity. If anyone is interested in trading on bitcoin or any cryptocurrency and want a successful trade without losing notify Mr Anderson now.Whatsapp: (+447883246472 )

ReplyDeleteEmail: tdameritrade077@gmail.com

Cool stuff you have got and you keep update all of us. what is leverage trading

ReplyDeleteI haven’t any word to appreciate this post.....Really i am impressed from this post....the person who create this post it was a great human..thanks for shared this with us. forex vs stock trading

ReplyDeleteYes i am totally agreed with article and i want say that this article is very nice and very informative article.I will make sure to be reading your blog more. You made a good point but I can't help but wonder, what about the other side? !!!!!!THANKS!!!!!!. Big thanks for the useful info.its never too late to invest. if you want to invest and hungry for the profit visit us for lifehacker.co.in/best-demat-account-in-india/

ReplyDeleteYour blog is truly insightful and engaging! Thanks for the well researched and informative content. When it comes to forex trading in India, it offers potential for earning profits through trading various currency pairs like USD/INR, EUR/USD, and more. The market operates between 9 am to 5 pm and allows traders to engage in margin trading with small deposits for potentially significant

ReplyDelete